Anti-Money Laundering in the United Arab Emirates

Anti-Money Laundering in the United Arab Emirates

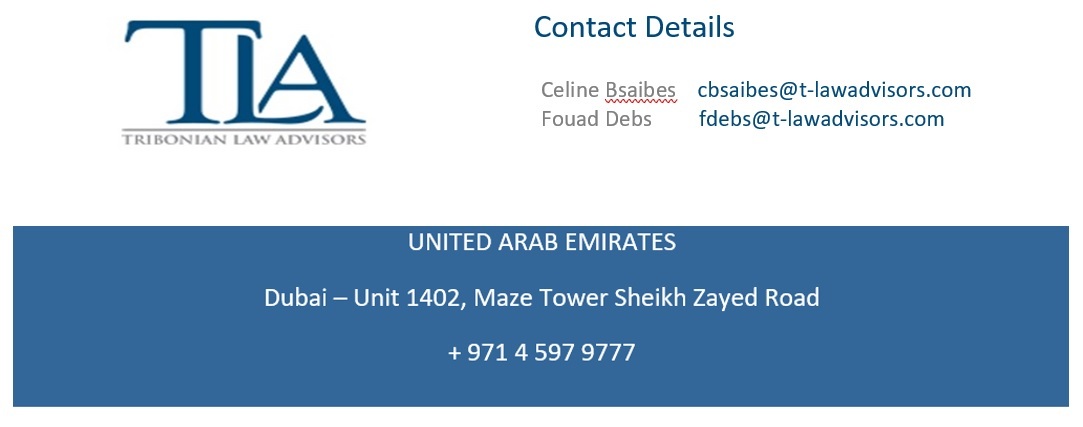

Celine Bsaibes and Fouad Debs, of ij member firm Tribonian Law Advisors, Dubai, outline the measures being taken in the United Arab Emirates to fight the practice of money-laundering.

Anti-Money Laundering in the United Arab Emirates

The UAE’s fight against money laundering started in 2002 with the entry in force of Federal Law No. 4 on Criminalization of Money Laundering. Since then, a number of laws and cabinet decisions developed the UAE’s tools in its fight. The main legal framework for anti-money laundering (AML) being Federal Decree Law No. 20 and its implementing regulations (the AML Law), was enacted in 2018, with the aim of enhancing the legal regime governing the AML to ensure compliance with international recommendations and standards. The new legal framework empowers the authorities to collect and use data related to AML, as well as impose stricter punitive measures and hasten procedures of freezing suspected money. In furtherance to the new legal framework, the UAE Central Bank has been actively enacting guidances aimed at tracing and containing AML activities.

Despite the UAE’s ongoing efforts to be at par with international standards on AML, in April 2020, the Financial Action Task Force (FATF), an independent inter-governmental organization tasked with developing AML policies, intimated to the UAE that it should tighten its grip against money laundering or it will risk being included on its international watch list (along with other countries such as the Cayman Islands, Malta and Panama). This led to the UAE visibly increasing its efforts to mitigate money laundering risks coming from the influx of investments and capital into the country.

- Licensed Financial Institutions (LFIs)

In response to the FATF’s recommendations, the Central Bank of the UAE established the Anti-Money Laundering and Combatting the Financing of Terrorism (CFT) Supervision Department in August 2020 dedicated to examine LFIs, ensure adherence to the UAE’s AML/CFT legal and regulatory framework, and identify threats, vulnerabilities and risks to the financial sector.

On 7 June 2021, the Central Bank of the UAE issued a guidance for LFIs on Suspicious Transaction Reporting with the aim to assist LFIs in their understanding and effective performance of their statutory obligations under the legal and regulatory framework. Through the LFI guidance that is based on the AML Law, the Central Bank urged LFIs to register and make use of the United Nations’ (UN) goAML application, a UN Office on Drugs and Crime application developed for use by the Financial Intelligence Units (FIU) of member states.

As set out in the guidance, the standard for reporting a transaction to the authorities, no matter its amount or nature, is based on suspicions on reasonable grounds. Knowledge of the underlying crime is not a requirement and there is no minimum threshold, hence laying a hefty obligation on LFIs to report on all suspicious transactions and activities. This requirement pressures LFIs to tighten the screws on their AML policies and practices in order to be law abiding and AML compliant.

The guidance directs the LFIs towards the use of the goAML application for filing both suspicious transaction reports and suspicious activity reports to the UAE’s FIU, and hence aligns the FIU’s reporting regime to the global system – a key recommendation by the FATF. Further, the guidance sets out a thorough method to identify suspicious transactions and activities, laying three “lines of defense” and in particular: (i) the first consisting of employees who are well-placed and trained to identify suspicious transactions; (ii) the second consisting of compliance employees who provide policy guidance and oversight; and (iii) the third being an automated testing program that is responsible for evaluating the design and operational effectiveness of the LFI’s compliance program. This comes in handy with the UAE’s push to integrate artificial intelligence, in both public and private sectors, where banks have already started to use developed artificial intelligence models for AML. However, the Central Bank is adamant that LFIs should not solely rely on automated monitoring systems and hence insists on having a human involvement in the AML processes, enabling the Central Bank to hold people in different positions of the corporate scale accountable for their actions.

The UAE has not been focusing its efforts solely on standard transactions and LFIs; in fact, it has also extended its AML policy to include Registered Hawala Providers, non-financial institutions and virtual assets.

- Registered Hawala Providers (RHP)

Hawala, Arabic for transfer, is a traditional practice for transferring money via non-bank methods. It allows for anonymity and can hence be ill-used for money laundering purposes. Pursuant to the RHPs Regulation of 2019, RHPs must have a provider certificate issued by the Central Bank in order to legally operate in the Emirates. The importance of a regulated hawala sector is its contribution to the financial inclusion of people without bank accounts, which has two main effects: (i) decreasing reliance on cash, hence, leading to less untraced activities; and (ii) restricting unregulated or unregistered financial institutions. This, in its turn, boosts the UAE’s AML efforts.

In this respect, on 15 August 2021, the Central Bank issued a guidance on AML/CFT for RHPs in view of assisting with the implementation of the RHPs’ statutory obligations whereby RHPs have to comply with the requirements for suspicious transactions reports as well as establish AML compliance programs including a compliance officer, due diligence for agents and customers, record keeping and transaction monitoring. Furthermore, RHPs must keep a bank account in an institution operating in the UAE to be used for settlement of hawalas. This makes it easier for the authorities to track the money trail of RHPs.

- Non-Financial Institutions and Small and Medium Enterprises

Non-financial institutions (including corporate service providers, real estate agencies and dealers of precious stones and metals) have to abide by the UAE’s AML policies pursuant to Decree Law No. 20 of 2018. Their obligations are threefold: (i) registering in the system of Committee for Commodities Subject to Import and Export Control (Automatic Reporting System for Sanctions Lists) as well as on the goAML application; (ii) maintaining a compliance officer; and (iii) exercising due diligence on clients and agents. As for other designated non-financial businesses and professions such as lawyers and accountants, and although no registration is required on the aforementioned platforms, they remain bound to take reasonable measures to identify money laundering activities. In particular, ministerial decision no. 533 of 2019 establishes the procedures and controls that must be undertaken by professionals in the legal field.

Many of the aforementioned institutions could be described as small and medium enterprises (SMEs). Complying with AML rules and regulations can sometimes weigh heavily on SMEs; in fact, many of them have been struggling in the wake of the COVID-19 pandemic and do not have neither the financial resources nor the necessary expertise to apply the guidance(s) of the UAE Central Bank. The extra cost accompanied with possible penalties for non-compliance could be a significant burden on such companies.

- Virtual assets

In September 2021, and in line with Recommendation No. 15 of the FATF concerning new technologies, the UAE’s National Anti-Money Laundering and Combatting Financing of Terrorism Committee adopted a regulatory framework for virtual assets (bitcoin, crypto assets) as a first step towards a fully developed legislation aiming at mitigating money laundering risks attached to the speed, global reach and anonymity of virtual assets. The committee also tasked both the Central Bank and the Securities and Commodities Authority with overseeing the implementation of the new regulatory framework indicative of the committee’s efforts to address gaps in the UAE’s AML / CFT framework by enhancing collaboration among various UAE authorities.

- Local and International Efforts

In late 2020, Abu Dhabi established a court focusing on money laundering and tax evasions. Almost a year later, in August 2021, Dubai set up a court specialized in financial crimes. In fact, the FATF report found that the UAE AML enforcement and convictions were too low. Courts with expertise and specialized knowledge are hence a welcomed addition to the UAE’s fight against AML. Moreover, the country is pursuing its AML drive as it contemplates expanding the AML legislative reach to non-profit associations particularly in relation to charities and fundraising.

The UAE’s efforts in AML have expanded beyond its borders where, in August 2021, the UAE’s FIU signed a Memorandum of Understanding with China Anti-Money Laundering Monitoring and Analysis Centre. As money laundering has become more of a cross-border crime than a national one, the MoU envisages boosting cooperation between those two countries in terms of exchange of information related to AML. The two authorities will cooperate on assembling, developing and analyzing AML intelligence.

In the near future, the UAE is expected to present a report to the FATF concerning its post-observation period showcasing the progress made since the FATF’s last report, an important milestone in the UAE’s journey in its fight against money laundering. The UAE’s strategy is an explicit act of compliance; with the outlined efforts it has been spearheading, not only will the country look to secure its role as a major player in the global financial system, but also solidify its position as a leading nation in the Arab world.